“I don’t know what we’re yelling about!” I always think back to Brick Tamland (Steve Carell) in Anchorman, but in many cases people are shouting at the top of their lungs the famous Dave Ramsey phrase “I’m debt freeeee.”

Q1 2019 Market Review

Values Investing

Elite Wealth Planning

What it is and why it matters

Elite wealth planning often plays a key role in the lives of today’s highly successful individuals and families—as well as those who are on the path toward great financial success.

With that in mind, here’s a closer look at just what elite wealth planning is—how it works and how it can potentially have a powerful impact on your life as you seek to build, preserve and protect your wealth.

The key elements of elite wealth planning

Before we can see what makes elite wealth planning so special, it’s important to understand the various planning strategies that make up the core of most elite wealth planning efforts.

Typically, elite wealth planning consists of seven main types of planning:

1. Income tax planning focuses on mitigating taxes on money earned by working—potentially enabling you to keep more of the money you make.

2. Estate planning involves using legal strategies and financial products to determine the future disposition of current and projected assets. Critically, it is important to determine who will own the assets and how they will be owned.

3. Marital (and related relations) planning entails planning for disruptions in the relationships between spouses and other partners. The intent is to take actions that will protect your family’s wealth.

4. Asset protection planning entails employing legally accepted and transparent concepts, strategies and financial products that are designed to help ensure your wealth is not unjustly taken.

5. Charitable tax planning addresses ways to be philanthropic in the most tax-efficient manner. The tax code fosters philanthropy, and charitable planning can help maximize the impact of your giving.

6. Business succession planning principally deals with helping entrepreneurs tax-efficiently transition their businesses to others, whether they are family members or not.

7. Life management planning addresses an array of concerns from a wealth management perspective—for example, structuring wealth to deal with longevity- and health-related concerns and actions.

In practice, there can be great overlap between these areas of planning, as well as opportunities for them to work together to accomplish more than they could alone. Some examples:

· By placing assets into an irrevocable trust for the primary purpose of transferring them to heirs—an estate planning strategy—elite wealth planning might pinpoint related strategies for protecting your assets.

· Business succession planning can be entwined with estate planning and potentially other planning specialties to support your goals in multiple areas.

Clearly, elite wealth planning is designed to help address your needs, wants and preferences across a full spectrum of planning specialties—potentially enabling you to optimally structure all the areas of your financial life.

PUTTING THE ELITE IN ELITE WEALTH MANAGEMENT

These various types of wealth planning are not new, nor are they in any way restricted to the very wealthiest among us. Lots of people can seek help with their charitable giving, marital planning or income tax planning.

Additionally, the level of technical expertise possessed by a professional wealth manager offering wealth planning isn’t a major differentiator. Wealth managers who are “just” technically adept and elite wealth planners both can be considered state-of-the-art in terms of their expertise (see the table below). All technically skilled wealth planners should be able to deliver essentially the same menu of solutions to their clients.

But there is one key characteristic that tends to make elite wealth management so—well, elite: the focus of the particular wealth manager.

Specifically, elite wealth planners focus intently on the human element of the wealth planning process—understanding their clients on deep, personal levels that go beyond the numbers that appear on their tax returns or balance sheets.

In contrast, technically adept wealth planners are generally more focused on the legal strategies and financial products such planners can offer. This doesn’t mean that technically adept wealth planners are not concerned with interpersonal relationships with their clients and the psychology of the affluent. But from an objective standpoint, interpersonal relationships with clients are of much less concern to technically adept wealth planners than they are to elite wealth planners.

While elite wealth planning can include some highly sophisticated thinking and solutions, we strongly believe the human element is much more important. In elite wealth planning, the client—be it an individual, a business owner or a family—takes center stage in all discussions and decisions. The elite wealth planner’s technical capabilities and solutions exist only to serve the client and provide what he or she wants most as a person.

That’s why we define elite wealth management this way:

Elite wealth planning is a comprehensive planning process that incorporates state-of-the-art technical expertise in legal strategies and financial products with the human element.

Unfortunately, the human dynamic is too often overshadowed by legal and financial expertise. To get truly meaningful results, a wealth planner must be acutely attuned to both the rational side and the emotional side of a person—the logical and the illogical. It’s this awareness of and sensitivity and responsiveness to the human element that we firmly believe makes wealth planning elite.

Bonus: The comprehensive process at the core of elite wealth planning enables both the wealth planner and the client to reveal more about themselves (including the way they like to work, their aspirations and even their limitations). Along the way, elite wealth planning creates a level of security and comfort that is the foundation of a rewarding relationship.

ACKNOWLEDGMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2018 by AES Nation, LLC. This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services.

Winning the Lotto: Dream Come True?

Random Performance

You may have heard of a big game happening in Atlanta on Sunday: Super Bowl LIII. (Do you remember what the Roman Numerals equate to?) The City has spent the past several weeks preparing for the estimated 150,000+ out-of-town guests to arrive, while over 1 million people are expected to attend the series of festivities leading up to the game.

This year’s match-up pits the Patriots vs. the Rams – two very different organizations. The Patriots are led by 41 year-old quarterback Tom Brady and coach Bill Belichick, who need no introduction. This organization has been the gold standard of the NFL for the last two decades, having been to 9 Super Bowls and winning 5 of them (much to the dismay of Atlantans).

On the opposite side of the field are the Los Angeles Rams, led by a 33 year-old energetic coach in Sean McVay and a 24 year-old quarterback, Jared Goff. The Rams are new to Los Angeles as of 2016, having spent the previous 20 years in St. Louis. By all accounts, a young organization in the NFL.

That’s right, the Patriots’ quarterback playing the game is 8 years older than the Rams’ head coach, and he was basically graduating high school when the Rams’ starting quarterback was born! But here they both are, playing a final 60 minutes to lift the Lombardi trophy and be crowned the champions.

————

If we look back at the performance of the NFL’s two leagues – the AFC and the NFC – over the last 10 years, is it any surprise that the Patriots and the Rams are playing in the Super Bowl?

The following charts show the playoff seeding of the AFC and NFC over the last 10 years, from 2009-2018. Note that it does not show how those games actually played out (i.e. #6 Atlanta beat #3 Los Angeles in 2017) because there is no final seeding after the games are played – just that the winners advance.

When looking at the NFC, what are your takeaways? Is it clear who was the best team over this decade? Atlanta has made the playoffs 5 times, but has nothing to show for it. New Orleans has 6 appearances and 1 Super Bowl victory. 40% of the time they didn’t even make the playoffs. Philadelphia has 5 appearances and 1 Super Bowl victory. 50% of the time they didn’t even make the playoffs. Green Bay has 7 appearances in the last 10 years but “only” 1 Super Bowl victory…should those odds be better? Meanwhile, the NY Giants have missed the cut on 80% of the last 10 playoffs, but they have the same number of Super Bowl victories as Seattle, New Orleans and Philadelphia.

The truth of the matter is that in hindsight, we could say that the Green Bay Packers appear to have been the cream of the crop in the NFC for much of the last 10 years. I think that is a reasonable statement. But in any given year, there was no guarantee what would happen, and certainly no accurate forecasts at the beginning of the season.

Now let’s look at the AFC. This one is a little different in that it is pretty easy to notice that the league was dominated by just a few teams. The aforementioned New England Patriots, the Denver Broncos and the Pittsburgh Steelers. In hindsight, we feel pretty good about saying, “Well, no wonder these teams were in the playoffs nearly every year and winning Super Bowls. Any fool could have predicted that.” Truth is, they might be right; but this has more to do with each of those teams having dominant, long-term quarterbacks that led their teams to victory. Tom Brady, Peyton Manning and Ben Roethlisberger are all future Hall of Famers.

Picking one of these 3 teams, you like your chances of being right. However, Pittsburgh made the playoffs just 6 out of 10 years; Denver just 5 out of 10 years. They each have 1 Super Bowl victory over this time period. (Also note that Kansas City, Indianapolis, Cincinnati, and Baltimore all have 6 playoff appearances as well).

Ah yes, the New England Patriots. 10-for-10 in playoff appearances. 5 Super Bowls played in, with 2 trophies hoisted (one will be determined on Sunday). Well, there is such a thing as periods of out-performance, and they have certainly enjoyed that over the last decade. But it is just as important to note that they had just 5 playoff appearances in their first 25 years in the league!

————

The same holds true in investing. Each year, there are winners and there are losers among the different asset classes around the globe. Like the AFC and NFC playoff charts above, the below chart provides no decipherable information as to where the best place to invest your money is, or when.

Source: Dimensional Fund Advisors

Anything can happen from one year to the next. If you don’t believe me, take a look at what Emerging Markets did in 2008 and 2009.

So what can we learn from all of this?

First, that past performance does not guarantee future results.

Second, that it is impossible to predict what will happen. We’re fooling ourselves into thinking we have some absolute knowledge that, in reality, is based on bias or emotion.

Third, that there can be periods of out-performance (S&P 500 from 2010-present and the Patriots over the last 20 years) relative to peers as well as periods of under-performance (S&P 500 from 2000-2009 and the Patriots of the 1970s and 1980s). However, there is no data to suggest that it is likely to persist in the future.

One thing we can all agree on: it is time for Tom Brady to retire.

2018 Market Review

New Year, Same You

Did you do it? What is on the list?

Surely, over the past few days, you’ve taken the time to jot down some new year’s resolutions for 2019. Exercise more. Eat better. Spend less time on the phone. Delete social media. Read more books. I’m guessing at least one of those made the cut.

The start of the new year is where we make the time to reflect on the year gone by and set our focus for what we want in the year ahead.

New Year, New You. Psychologically, that is such a euphoric feeling knowing that we all have this great opportunity ahead of us. We are choosing to set goals for things that push us to become better; things that are ultimately in your control.

With investing, there are certain things out of your control. The performance of the market to end 2018 was one of those things. (Spoiler alert: the performance of the market is always outside of your control.)

But there are things that you can choose and that you can control when it comes to investing. You can control your asset allocation and your risk. You can control how much you are saving and how much you are spending. You can control your expectations and your knowledge of investing and how markets work. Most importantly, you can control how you react to events that cause emotional turmoil.

Hopefully you have a true financial plan in place and the recent market volatility has not duped you into making short-sighted or irrational decisions. If that’s the case, then New Year, Same You.

The Value of Multigenerational Family Meetings

If you’ve amassed sizable wealth, or are on the right path and getting there, it may be time to consider how to pass on some of that money to children and grandchildren—without creating big problems that could harm their futures and destroy family harmony.

The fact is, family wealth—how it’s managed, transferred and used—can generate major drama among family members. As wealth grows, so does the potential for that money to foment conflicts and bad financial decisions that can reduce a family’s financial position and even ruin intra-family relationships forever.

The good news: We can look to the strategies used by today’s ultra-wealthy families to avoid or mitigate such negative outcomes—and find ways to adopt similar strategies in our own families.

One of the most effective tools harnessed by the ultra-affluent is the family meeting—which is used to educate heirs and potential heirs about sound financial decision-making, to identify shared family financial values and to maintain (and grow) family wealth in a unified manner.

Family meeting benefits and advantages

Family meetings can help avoid the thorny problems that can arise when inheritors who receive substantial assets lack the proper preparation and education to manage the money prudently.

Regular family meetings can also help families keep their wealth together and intertwined, which can have major advantages such as:

· Being able to access certain types of high-minimum investments

· Leveraging a larger fortune to lower the cost of financial advice and services

The underlying objectives are family cohesiveness, superior management of the family’s future across the generations, and the preservation and growth of the family wealth.

The family meeting principally provides a venue for multiple generations to discuss financial matters. Common topics covered at well-run family meetings include:

· Promoting financial literacy in future inheritors

· The family investment philosophy

· Family philanthropic values and activities, and how they are financially supported

· New business ventures and how to fund them

Family meetings are where a family’s values and mission are discussed, debated and honed. Governance structures are often addressed and refined. In many cases, family meetings are great settings to plan the action steps needed to prepare the next generation for family leadership roles. Often, the end result is greater feelings of cohesiveness, trust and support among family members of various generations.

Four Steps To A Successful Family Meeting

Step #1: Planning the meeting

The starting point is specifying the goals for the family meeting. The more specific and refined the goals, the better. An agenda based on those goals should be created, delineating what is to be discussed and what decisions can hopefully be made. Based on the nature of the topics on the agenda, supporting material might be required (such as the financials of the family business or the performance of the family’s investment portfolio).

Often, the planning part will be shared and rotated among various members from meeting to meeting. When it’s your turn, be sure to get input from all family members who will be involved. By taking suggestions from everyone into account, the family is more likely to achieve the desired group results.

Add some fun: Many families also include fun activities as part of their family meetings—such as golfing, a family softball game or a wine-tasting event. These bonding moments are nice on their own, and also help promote a better meeting.

Step #2: Conducting the meeting

The focus of the family meeting should be the goals and agenda. Therefore, it is usually wise to mitigate day-to-day distractions—for example, by holding the meeting at a resort or a tucked-away family property.

The most effective meetings we’ve seen tend to have an outside professional—a neutral third party—involved as a facilitator. This individual will help address the more complicated and difficult issues and keep the discussions on track and focused on the end goals and action steps. The facilitator also helps ensure that all family members are involved and contributing, and can help mitigate conflicts that may arise.

The types of third-party professionals commonly serving in this role include:

· Attorneys and accountants

· Wealth managers and multifamily office senior executives

· Family business consultants and life coaches

Step #3: Follow-up actions

Typically, a set of action-based to-do steps results from a family meeting. These actions often need to be turned into formal projects, with milestones and clear expectations about who will be accountable for specific steps. The third-party facilitator or family members can be responsible for mapping out how to follow up after the family meeting. It is also worthwhile to specify how the subsequent actions will be tracked and reported back to the family.

Step #4: Assessment of outcomes

After starting with particular goals and then identifying what actions need to be taken to achieve those goals, the final step entails determining the degree of success attained.

Based on the assessment of the outcomes, new actions to help reach the stated goals are identified. These can be a refinement of current actions or a different approach entirely. Moreover, the results achieved always factor into the goals and agenda for the next family meeting.

Keep in mind: Every family has its own special dynamics and traits. Thus, the process described here can be modified depending on the aims of the family.

ACKNOWLEDGMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2018 by AES Nation, LLC. This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services.

"Should I..." Series: Invest Now or After Election Day?

I have money in savings and want to invest it. Should I wait until after Tuesday, November 6 – the midterm elections – to get my money invested?

No matter who you are, there are likely two things that have crossed your mind recently: market volatility and political discourse. Thus, it would seem natural that both factor together when deciding whether now is the time to invest idle cash.

I was recently asked this very question, and along with that, I was asked what the market did recently. My response was that the market was higher than where it was a week ago and lower than where it was a month ago.

But so what? That is what the market has done. It does not tell us anything about what the market will do. And there is certainly no such thing as what the market is doing. Notice the subtle, but extremely important, differences there.

Markets don’t always act in ways that we think are rational. It is impossible to silo independent drivers of what makes the market go up or down for any given period of time. Election day, tariffs, taxes, earnings reports, jobs reports…these are all just some of the factors that we’ve heard about recently which work in beautiful harmony and can impact what drives market movements. Or at least our perception of what drives market movements.

To decide whether now is the time to get cash invested, focus instead of what you know and what you can control:

1. We know that mathematically speaking, a dollar invested today has a higher expected return than a dollar invested tomorrow. Simple enough concept, but there is more to it than that behaviorally.

2. How much cash am I looking to invest relative to my overall wealth or net worth? Is it a material amount or just another contribution in a long line of contributions?

3. What is the money for? It goes without saying that if you’ll need this money for something in the short term, then it likely should not be invested at all. If this money is for long term wealth building and/or retirement, then it should be invested according to your overall investment strategy in accordance with your specific risk tolerance.

If you’re investing for the long-term and have an investment strategy in place, then what happens this week, next month, or the next 12 months is almost irrelevant. It’s also unpredictable.

Notice we haven’t even touched on the psychological factors that go along with sitting on cash. That is vitally important to understand, and we’ll cover that next time.

Wild Wild Week

Last week was a wild, wild week.

For a few days, it was one of those weeks where we were reminded what it feels like to lose money. On Wednesday, we experienced a very rough day in the market. S&P was down 3.29%, Dow down 3.15%, Nasdaq down 4.08%. In fact, it was the worst day in the market since February. Eight whole months – an eternity! Thursday was not any better.

Here comes Friday, with surging stocks and the S&P 500’s biggest gain since April 10. What are we to make of all of this?

If you’re like many, you turned to news outlets to get a better understanding and probably saw things like “Fed policy: crazy or sane?” or “S&P 500 rises for first time in 7 days” but still having “Worst month since March” but at the same time “Nasdaq has biggest jump since March.” By the way, all of the aforementioned headlines came in one 15-minute window on Friday morning. Make sense yet?!

To be blunt, I do not recommend you changing your investment strategy based on what happened last week, this past month, or even this year. If what happened last week has left you in emotional distress, you may need a reality check. Returns are only possible by taking risk. Rather than chasing returns, it’s imperative that you understand the risks you take in your investments.

Arguably the biggest rule about investing is that no one has a crystal ball. Worth repeating – no one can predict what will happen and when. It’s not cliché…it’s reality!

The best remedy for a week or month like we just experienced is having an investment strategy. Whether you are a DIY’er or work with an advisor, you should have a strategy and know what that strategy is well in advance of any shakeups.

However, even when we have reasonable evidence that a particular investment strategy will work, the hardest part is the discipline it takes to stick to that strategy through thick and thin. It is so difficult because that little voice in your head says, “What if this doesn’t work anymore? What if I’m wrong? What if my neighbor/friend is supposedly doing better than me?” Often times, that little doubt is all it takes to turn steadfastness into the emotional turmoil that has ruined generations of investors.

The key to successful investing as I see it is two things, listed in order of importance.

Stay disciplined. This requires hard work. It’s easy to be disciplined when everything is going your way, but it’s much harder when the tide is turned against you.

Remain diversified. Over-concentration of investments (to one company, one sector, one asset class, or one country) is one of the top reasons anyone ever ends up bankrupt and has a poor investment experience.

Last week was a wild, wild week. It felt like that 2010 Wimbledon match between John Isner and Nicolas Mahut. You know, the one that started on a Tuesday and ended on a Thursday? Where the 3rd and 4th sets went to a tie-break, and the match finally ended in the 5th set at 70-68. You remember, because it was emotional!

The Importance of Personal Umbrella Policies

What would happen if you or your child caused a car accident that resulted in serious injuries or the deaths of others?

How would you pay for the treatment and damages of someone who was hurt in your home and claimed negligence? What happens when they claim to have suffered greatly because of the injury?

What if your dog was attacked by a stranger on your property and bit the person in self-defense—but you were still sued?

These are questions that anyone could face. However, one component of a wealth protection plan that is often overlooked or underused—even by the affluent—is the umbrella policy.

Here’s why an umbrella policy can make sense if you have significant assets.

The benefits of umbrellas

You have insurance policies on your house and vehicles. You might also insure other types of property you own (boats, airplanes, etc.). But do you have enough coverage, considering your personal wealth?

If you’re financially successful, the answer may be a resounding no.

The reason is that most insurance policies top out at around $500,000 of liability coverage. That may not be enough if you find yourself involved in a serious accident. For example, people who get hurt on your property may seek much more than $500,000 in damages.

That’s where an umbrella policy (also called an excess liability policy) can make a big difference. An umbrella policy kicks in when your other liability policies (such as your car insurance) hit their limit. For instance, let’s say you are involved in an accident and are being sued for $1 million, but your car insurance covers only $300,000. In that case, your umbrella policy could cover the difference so you don’t have to use personal assets.

Clearly, then, an umbrella policy can be useful in helping to protect your assets from larger claims and lawsuits.

To have an umbrella policy, you need to have the other insurance policies, such as car or homeowner’s insurance, already in place.

Make sure there isn’t a gap between your other policies and your umbrella policy. Where your car insurance ends, for example, the umbrella should take over—otherwise, you’re on the hook for that gap. And if the underlying car insurance policy is not addressing certain risks, then the umbrella policy can also miss covering these risks.

A BIG ENOUGH UMBRELLA?

We find that most wealthy individuals and families don’t have large enough umbrella policies to adequately protect their assets. If a legal judgment is greater than your liability coverage, you are going to have to come up with the difference—which may mean selling assets, possibly at fire-sale prices because of the bind you’re in.

A general rule of thumb is that if your net worth is $20 million or less, make sure your umbrella policy covers what you’re worth. If you are worth more than $20 million, it becomes a question of how much risk you’re comfortable taking on.

Many ultra-wealthy individuals, for instance, will get as large and comprehensive an umbrella policy as possible. While the odds of having to use it are in their favor and it’s even more unlikely that they will reach the limits of the policy, the possible financial downside from a serious accident and substantial lawsuit is something they prefer not to even consider. As one person with a $10 million umbrella policy told us, “It costs less than putting an attorney on retainer to defend you in the event of a suit.”

That said, it can be challenging to insure up to the amount you wish. That’s because some insurance companies cap the size of the policies they offer, usually at $5 million. If you require more than $5 million in coverage, you may need to enlist a specialty insurance company, which might be able to offer policies of up to $100 million.

The cost of coverage

How much will a hefty umbrella policy set you back? A number of factors determine the cost of coverage, including:

· Number of homes and where they are located

· Number of cars and the number of people being covered (including their driving histories)

· Number of boats and planes

· Amount of existing liability coverage you have before adding the umbrella policy

The good news is that umbrella policies tend to be relatively inexpensive, because the severe occurrences that trigger them are uncommon.

The upshot? If you don’t have an umbrella policy, run—don’t walk—and get one. If you do have an umbrella policy, make sure you’re sufficiently covered—and boost that coverage amount if you’re not.

ACKNOWLEDGMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2018 by AES Nation, LLC. This report is intended to be used for educational purposes only and does not constitute a solicitation to purchase any security or advisory services.

Market Review - Q3 2018

Return on Investment

Defined as the ratio between net profit and cost of investment of some resources.

Return on investment, or ROI, is used to evaluate the efficiency of an investment and also to make a comparison of the efficiencies of different investments. The calculation is both straight-forward as well as versatile, and can be applied to many settings. Most often in the financial world, we might look at the ROI of our favorite stock holding (which is undoubtedly APPL or AMZN at the current time, right?). Say you bought AAPL at $100/share in July 2016 and about two years later it’s worth$222/share.

ROI = (Gain from investment - Cost of investment) / Cost of investment

ROI APPL = ($222 - $100) / $100 = 122% …Not bad!

In the above example, the resource we invested was capital. However, one could argue that time is our most valuable resource. This morning I attended a great event hosted by Roswell NEXT, a local community organization which I am a part of. There, I had a conversation with someone about ROI.

It seems natural that with our finite amount of time in each day, we look to join organizations, attend certain events, or talk to certain people based upon our perceived (or desired) ROI on that time spent. It makes good business sense, and hopefully you will be able to measure that by way of landing a new account or signing a new contract.

But have you ever considered the importance of being involved with or doing something simply because of your interest in it? Volunteering with an non-profit you are passionate about; joining a local community organization; introducing yourself to the new neighbors who just moved in; or trying a new sport or activity.

Time is our most valuable resource. Time spent on personal pursuits should be considered independently of professional networking and business development, but they should hold equal weight. There’s an ROI to those personal pursuits, though it may not be as efficiently measured.

"Should I..." Series: Start My Dream Business, But Leave My Secure Job

Should I start my dream business while the economy is good? I have enough money to get my business started, but I would be leaving a secure job. What advice can you give me based on what you have seen from your clients?

If you are even considering being an entrepreneur, then chances are you already have the work ethic and drive to be successful. If you are thinking of becoming a business owner, then surely a strong and growing economy can only help your cause.

In addition to having enough money to start the business itself, you need to have money saved to replace the paycheck you are giving up. What if you can’t afford to pay yourself for 6 or 12 months? How will you pay your mortgage, car insurance, children’s daycare, or the multitude of other expenses that you have? Where will your health insurance come from?

You also need to have a source of additional capital for your business. This may be additional savings you have, a loan from a family member, or a line of credit with a bank. One thing is almost certain, once you open the doors you will need more money at some point or another.

Starting a business has infinite challenges and obstacles that must be overcome…there are entire books written on this very subject. The risks you take will hopefully lead to a great reward down the line. Make sure you are financially prepared before taking the plunge.

More About the S&P 500

Recently, we took a look at the S&P 500 which included a great visualization of the market cap of companies that make up the index.

To many in the investment world, the stock market is still on its bull-market run (though there is some disagreement on the technical length of it). This means that companies which make up the index have grown in value as a whole. Individual companies have jockeyed for position with some being added to the list of largest 500 companies in the U.S. while others have fallen off.

Josh Wolfe brings us another great visualization comparing the 10 largest companies in the S&P 500, from March 2009 to August 2018.

Time surely flies, and there are so many historical lessons gleaned from market data. Arguably none more obvious than the rise of Amazon. But what about the tumultuous decade that Bank of America experienced? Or the fall of IBM, relatively speaking? Only three companies in the top 10 in March 2009 remained there in August 2018.

Perhaps the most simple lesson learned from a chart like this is that we don't know what will happen in the future. What we believe to be the best companies at the current time may fall off in the not-too-distant future. Companies that we don't yet know anything about or are not evenly publicly traded may one day dominate the headlines and market share.

"Should I..." Series: Interest-Free Credit Cards

Should I take advantage of a 0% interest credit card? What are good rules to follow regarding these offers?

Full disclosure -- I have fallen for this before. When I was just out of college, I was making a big purchase and was offered to open a store credit card to give me 5% cash back and 0% interest for a period of time. I accepted, with the plan of immediately paying off the purchase with cash I had. In my mind, that was a free 5% discount.

The unfortunate reality for most people is that store cards will end up costing them more in the long run. Even if they start with good intentions, many people do not fully pay the purchase off before the deadline. If you can’t pay it off quickly before the interest charges kick in, it will cost you more over time.

Many store credit cards carry interest rates of 20% or higher. A good question to ask is, would I be willing to pay 120% of the retail price for that item? Stick to cash or debit cards, or credit cards you already have if you are capable of paying them off each month.

One last thing: never open a new credit card if you are in the process of getting approved for a loan, or think you may in the next 3-6 months.

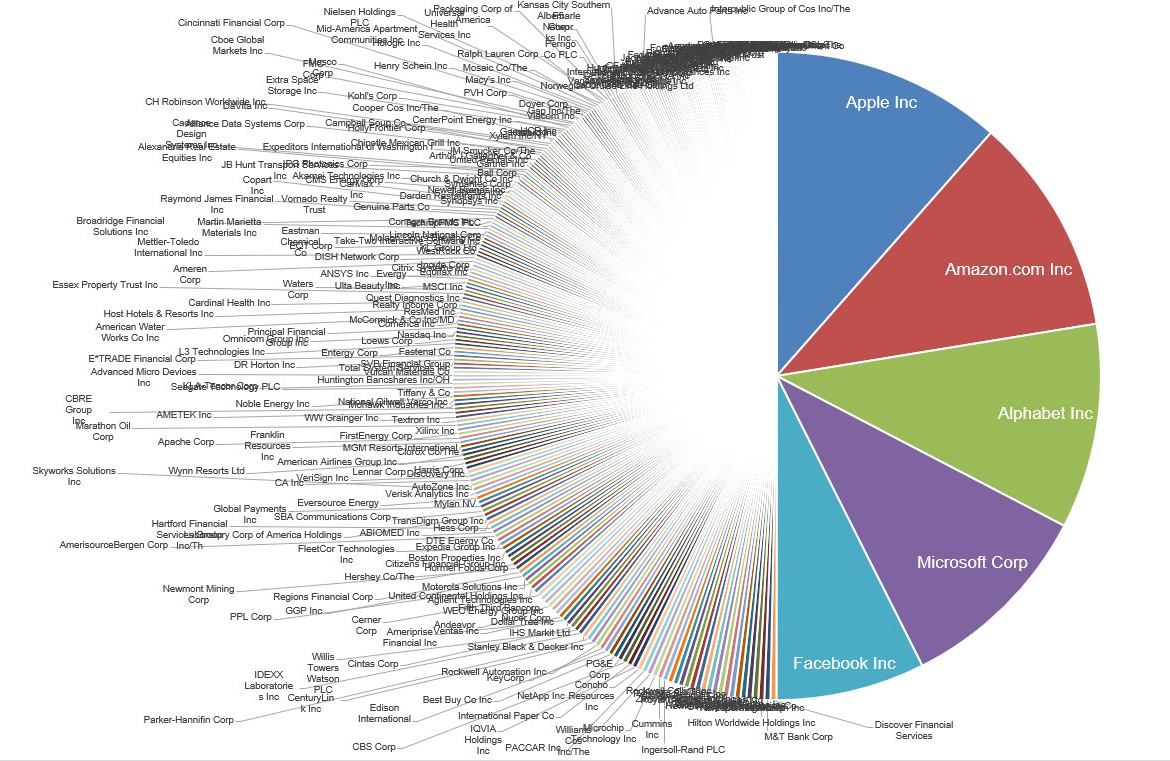

About the S&P 500

The S&P 500 is an index of the 500 largest U.S. companies. It is market-capitalization-weighted based on those companies' values. When people talk about "the market," they are often referring to the S&P 500 (other times the "Dow" which is an index of just 30 stocks).

Michael Batnick, Director of Research at Ritholtz Wealth Management, took the finance world by storm recently by putting together the following chart and data. He points out that the market cap of the top 5 S&P 500 companies is $4,095,058,706,432 while the market cap of the bottom 282 S&P 500 companies is $4,092,769,755,136 (as of July 2018).

Astounding!

What we can learn from this is that there are a few select companies that can control the narrative of "the market." These are companies that we all know, recognize, and may even love. But that should not dictate how we invest.

It's true that FAANG and other mega-cap stocks have performed well, but so have companies in other deciles of the S&P. It is just as important to remember that there are about 3,000 other publicly-traded companies in the US and thousands more abroad.

"Should I..." Series: Buy a House Now or Wait

Welcome to my “Should I…” series! In this series, I will answer questions that I hear frequently from my clients. I would love to answer your questions too. So leave any questions you may have in the comments below and I will answer them in a future “Should I…” post.

Should I buy a house now? I have a down payment saved up but I know home prices are high right now. Should I wait and hope they fall?

You know what they say about trying to time the market, right? Well, the same can be true for real estate. As a buyer, you are obviously looking for the best house your money can buy you, and right now, houses are expensive. But don’t let that deter you from purchasing a home…if you are ready. Instead of focusing as much on the perceived “hotness” of the housing market right now and what you think it may or may not do in the future, turn your attention to the other factors that matter just as much.

First, get pre-approved for a loan before you even start to look. Even better, after you’ve been pre-approved, look at your budget to determine what you can actually afford, not just what the bank will lend you. Where do you fall within the Housing Expense Ratio and Debt-to-Income Ratio? In addition to a down payment, will you need additional capital up front to update anything before you move in? There are ALWAYS unexpected expenses that come with owning a new home.

Second, find a reputable realtor that will help you with your buying process. Most often, the seller pays real estate commissions for both sides of the transaction, so there is no cost to you in having a good realtor. It could, however, be costly if you don’t.

Third, determine where you want to be. You may envision yourself in a specific neighborhood or part of town because it fits your life right now. But have you considered the schools in that area (even if you don’t have kids)? Have you checked out the property taxes there? How about traffic and your commute, growth of the city and surrounding areas, parks and community resources, or other variables? These may not necessarily matter to you now, but they may in the future and can also affect re-sale down the road.

Buying a home should not be done solely based on the purchase price. It is one of the biggest purchases one will make in their lifetime. Be pro-active, and when the time is right for you, you will find a great place to call home.

"Should I..." Series: Sell My House to Realize the Equity

Welcome to my “Should I…” series! In this series, I will answer questions that I hear frequently from my clients. I would love to answer your questions too. So leave any questions you may have in the comments below and I will answer them in a future “Should I…” post.

Should I sell my house now to take advantage of the equity while prices are still high?

You can certainly cash in the equity you have to move into a house that is bigger, in a better neighborhood or school district, or just better meets your family’s needs.

But keep in mind that chances are the new house you’re looking at has also increased in value and thus your equity may not get you as far as you think (or hoped) it would. Crunch the numbers to be sure you will be able to afford the new monthly expenses associated with a larger, more expensive house and that the equity you take out of your home will cover the down payment for a new one. And will you have to use any of that equity for moving expenses, new furnishings, or remodeling?

Conversely, we get the question all the time of whether it makes sense to sell your current house to downsize to something smaller, and keep that equity. In all likelihood, downsizing to a smaller house in the same area may still require all of the equity you get out of your current house, after paying off any mortgage.

Some people consider selling their home, investing the equity and renting until housing prices come back down. But can you truthfully say you know when that will be? Not to mention, you give up a fixed monthly mortgage payment for the risk of paying increasing rents which are beyond your control.